We provide specialized winterization services to safeguard your pool during the off-season, and when spring arrives, we handle the thorough opening process.

Recent Posts

Newsletter

Sign up to get update news about us

Halal Market Size is forecast to reach $ 3,659.53 Million by 2030, at a CAGR of 5.70% during the forecast period 2024–2030. Halal Certification is a method that ensures the quality of the products is according to the rules implemented by the Islamic council. Halal‑certified products are increasingly being adopted among consumers across the world owing to the growing awareness about the importance of quality assurance, reliability, and food safety. The rise in the adoption of halal processed milk and other milk products in developed nations, growing demand for halal grain products, an increase in the adoption of halal meat products among the young population, rise in the demand for halal cosmetic products, and the growing investment by the key players to develop halal‑certified pharmaceuticals are the factors that are set to drive the growth of the Halal Market for the period 2021–2026.

The report: “Halal Market Forecast (2021‑2026)”, by Industry ARC, covers an in-depth analysis of the following segments of the Halal Market:

Geographically, the Asia‑Pacific Halal Market accounted for the highest revenue share in 2020 and it is poised to dominate over the period 2021–2026 owing to the rise in the adoption of halal processed milk and other milk products in developed nations.

The increase in the demand for halal meat products among the young population is driving the Food and Beverages segment. However, high certification costs for halal products are one of the major factors that are said to hinder the growth of the Halal Market. Detailed analysis on the Strength, Weakness, and Opportunities of the prominent players operating in the market will be provided in the Halal Market report.

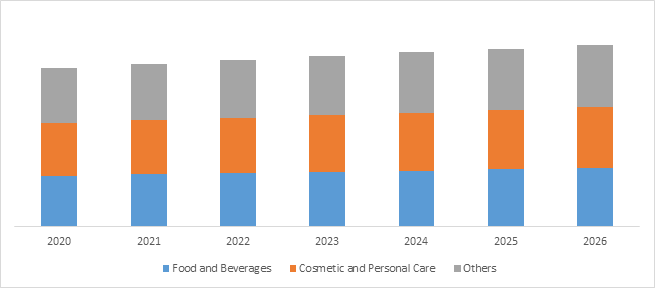

Halal Market Size, By Product Type, 2020–2026 (USD Million)

The Halal Market based on the Product Type can be further segmented into Food and Beverages, Cosmetic and Personal Care, and Others. The Food and Beverages segment held the largest share owing to factors such as increased demand for halal processed milk and natural milk products and heightened product launches by key players. The growing demand for halal meat products among the young population is further driving this growth. The Cosmetic and Personal Care segment is estimated to be the fastest‑growing segment with a CAGR of 9.8% over the period 2021‑2026. This growth is attributed to the growing investment by key players in developing halal cosmetic products and increasing awareness of their benefits.

This segment can be further broken down into Supermarkets/Hypermarkets, Online Channels, Specialty Stores, and Others. The Supermarkets/Hypermarkets segment held the largest share in 2020 due to cost‑effectiveness and availability of a wide range of halal meat and grain products across brands and price points. Attractive schemes and dedicated product shelves amplify this growth. The Online Channels segment is estimated to be the fastest growing with a CAGR of 10.4% over 2021‑2026, driven by rising demand for digital shopping experiences, adoption of halal processed products online, and growth in doorstep delivery.

Based on Geography, the market includes North America, Europe, Asia‑Pacific, South America, and Rest of World. Asia‑Pacific held the largest share at 34% in 2020, driven by adoption of processed milk products and product launches in developed nations. Growth in halal meat adoption among the younger population further supports this lead. North America is projected as the fastest growing region during the forecast period, propelled by rising demand for halal grain products and growing investments in halal pharmaceutical development.

High Certification Costs: Companies are investing heavily in R&D for halal grain and meat products, yet the steep cost of certification remains a key deterrent to market expansion.

Key players in this market are deploying strategies like product launches, mergers & acquisitions, joint ventures, and geographic expansion. Prominent companies include Kellogg Company, Nestlé SA, Glanbia Nutritionals, Clara International, Inika Organic, Ivy Beauty Corporation Sdn Bhd, Al Islami Foods, Sampure Minerals, Halal Cosmetics Company, and Elaheh Halal Cosmetics Inc, among others.

In January 2021, Al Islami Foods launched its first halal plant-based burger made with organic sunflower and plant-based proteins to cater to increasing demand for vegan alternatives in the UAE.

The top 5 companies in the Halal Market are:

1. Cargill Inc.

2. Nestlé SA

3. Al Islami Foods Co

4. Unilever Plc.

5. Saffron Road

The report covers detailed sections including: